By Gary Goms

Contributing Writer

For me, sourcing automotive chemicals and motor oils goes all the way back to 1957 when I worked at my corner service station.

Since we were in a small town without a local parts jobber, we bought our oil additives and chemicals from an out-of-town distributor. Our gasoline and motor oil came from our local-branded petroleum products distributor. We bought independent motor-oil labels from various wholesalers by the case. To save our customers money, we hand pumped most of our company-branded motor oil from barrels into one-quart glass oil bottles topped with pointed pour spouts. Such was the technology and practice of those days.

The Not-So-Happy Days

Since early oil ratings weren’t truly reflective of oil performance, our primary concerns about motor oil were whether it was detergent or non-detergent, straight-weight or multi-viscosity. Through experience, we found that some oil brands would quickly oxidize and cause varnish to form in new engines equipped with hydraulic lifters. The lifters would stick and become noisy, to the extreme irritation of many new-car owners.

In other instances, the motor oils and gasolines of that era left hard carbon and lead deposits in the cylinder head and valve ports, which would shorten valve life. Similarly, oil sludge would accumulate and clog the engine’s oil pump screen and oil galleries.

The result of excessive cylinder-head deposits and poor lubrication was that many engines of that era rarely lasted more than 70,000 miles without a major valve or connecting rod bearing failure. It goes without saying that our selection of motor oils was based not on oil ratings, but on our collective experience with various brands.

Today’s Standards

Today, increasingly stringent refining standards have complicated the sourcing of engine oils. To illustrate, while American Petroleum Institute (API) ratings have served as the industry standard for many generations, newer standards, such as those represented by the International Lubricant Standard and Approval Committee (ILSAC), the European Automobile Manufacturers Association (ACEA), the Japanese Automobile Manufacturers Association (JAMA) and the Korean Automobile Manufacturers Association (KAMA), are now appearing on oil-bottle labels.

Getting Rated

In addition to the API, ILSAC and ACEA ratings listed on most engine oils, some auto manufacturers are now adding proprietary ratings for oils that are engineered for specific engine applications. There are several reasons for this.

First, anti-scuff additives drastically shorten catalytic converter life.

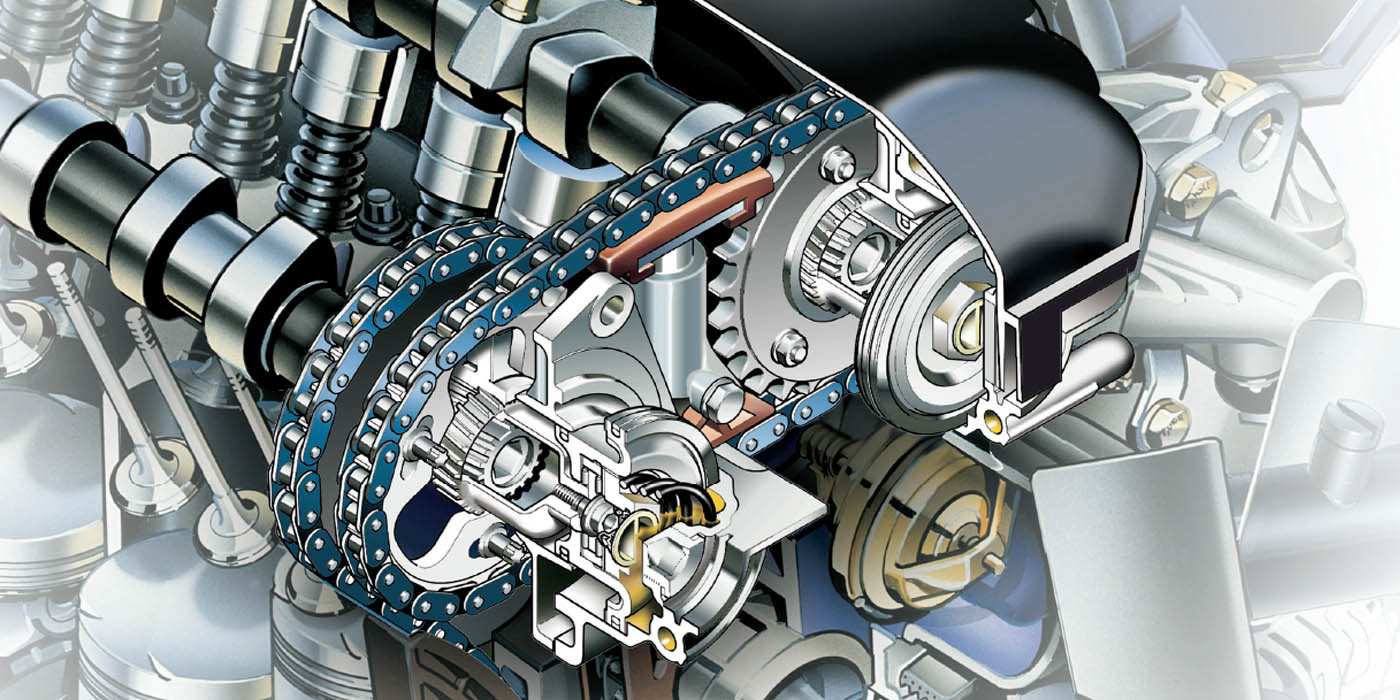

Second, overhead camshaft engines are designed with less reciprocating weight in the valvetrain, which reduces stress on the camshaft lobes and thus reduces the need for anti-scuff compounds.

Third, engines may tend to form crankcase sludge earlier because engineers have fine-tuned air metering into the engine by reducing positive crankcase ventilation system flow. In addition, some cylinder-head designs may run hotter, which increases oil temperatures and hastens oil oxidation. Oxidation causes the oil to varnish internal engine surfaces and ‘gel’ into a viscous fluid, resistant to flow.

Last, many manufacturers are increasing oil-change intervals, which further exacerbates the demands upon any engine oil. As a result, engine oils must meet not only API, ILSAC and ACEA standards, but also the auto manufacturer’s proprietary ratings.

Incompatible Lubrication

A recent instance in my own shop involved something as simple as buying automatic transmission fluid for a high-end Asian vehicle. Looking over the service data, I found that the “type 2” fluid originally installed in the vehicle had been replaced by the latest “type 4” fluid. A technical service bulletin stated that the two fluids should not be mixed.

A transmission fluid was available from my local jobber that would meet the OE specifications. Was this specification meant to be a “top-off” specification or a “refill” specification? The difference can be critical on a $3,000 automatic transmission.

Tech’s Influence  The tech is the person ultimately responsible for choosing the correct lubricant for a specific application. Meeting the conditions of extended warranties also makes the correct choice of lubricants even more critical for the DIY or installer. Consequently, it’s extremely important for any technician or service manager to check the owner’s manual and applicable technical service bulletins for correct lubricant information.

The tech is the person ultimately responsible for choosing the correct lubricant for a specific application. Meeting the conditions of extended warranties also makes the correct choice of lubricants even more critical for the DIY or installer. Consequently, it’s extremely important for any technician or service manager to check the owner’s manual and applicable technical service bulletins for correct lubricant information.

In most cases, a local jobber can supply the correct lubricants. For many proprietary applications, however, nameplate specialists may find themselves buying OE-spec lubricants directly from local dealerships.

Additives As I stated at the outset, the oil- and fuel-additive industries were built on the premise that early engines accumulated huge amounts of carbon in the cylinder head and sludge in the crankcase. However, assuming that maintenance schedules are followed, most modern engines don’t require oil additives to keep the internals of the engine clean and well lubricated.

As I stated at the outset, the oil- and fuel-additive industries were built on the premise that early engines accumulated huge amounts of carbon in the cylinder head and sludge in the crankcase. However, assuming that maintenance schedules are followed, most modern engines don’t require oil additives to keep the internals of the engine clean and well lubricated.

Of course, the tech is always faced with an engine that hasn’t been maintained and is in need of internal cleaning and lubrication. When used as directed, most name-brand oil additives will perform that task in an efficient and cost-effective manner. The danger is that the engine is sludged well beyond the point of remediation with an oil additive. In this case, the engine should be flushed, repaired or replaced.

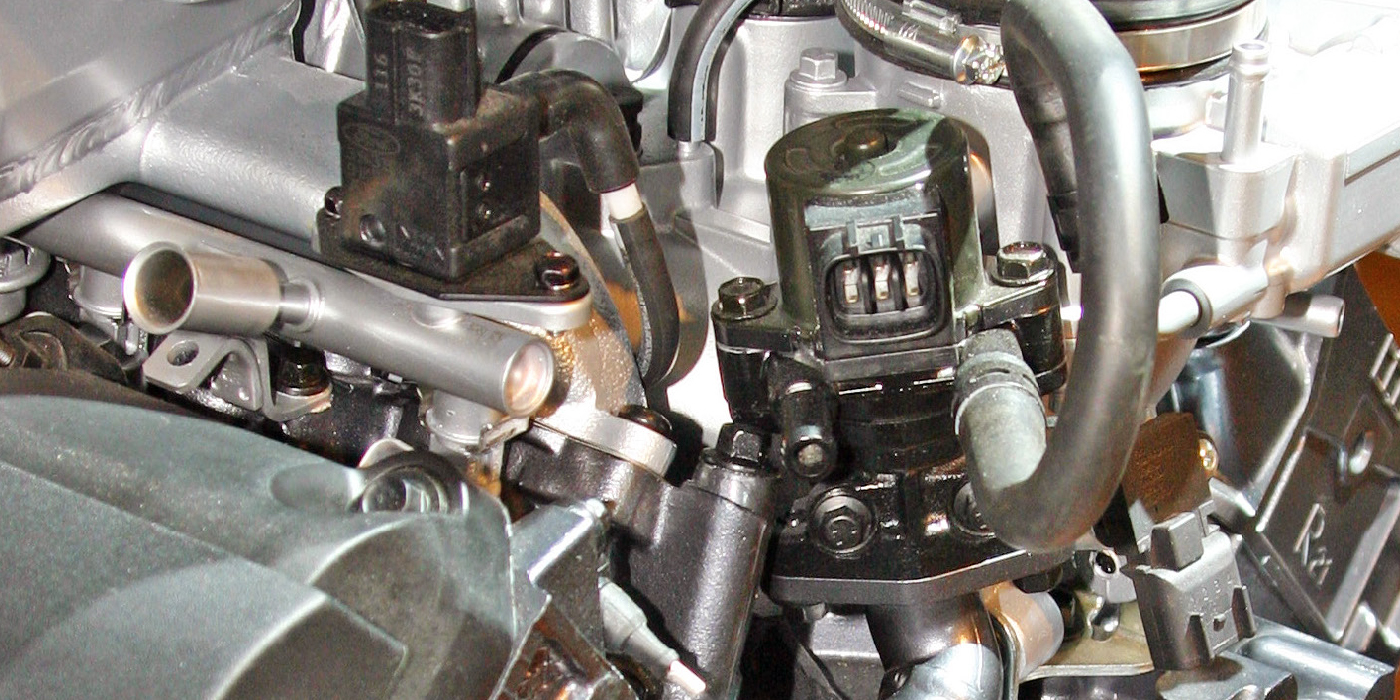

As for fuel additives, many engines driven in slow-moving traffic can develop clogged injectors and carbon buildup on the valves. Low-quality gasoline contributes to the clogging and carbon buildup, until the engine begins to perform sluggishly or runs roughly enough to cause a misfire condition. In addition, a fuel additive may be required to remove excess moisture from the fuel tank.

Whatever the need, some shops use additives on an occasional basis and others, such as fleet or professional repair shops, might use them for preventive maintenance.

Meeting Customer Needs Obviously, the professional oil, additive and chemical markets are becoming much more complex. Whereas the DIY market might be more price sensitive, the professional market is becoming more performance sensitive. Sure, professionals still want the best price, but they also want oils, additives and chemicals that meet the needs of customers.

Obviously, the professional oil, additive and chemical markets are becoming much more complex. Whereas the DIY market might be more price sensitive, the professional market is becoming more performance sensitive. Sure, professionals still want the best price, but they also want oils, additives and chemicals that meet the needs of customers.

Once professionals find a brand of oils, additives and chemicals that perform, they usually continue to demand that brand. In addition, they need additives to meet specific needs, like loosening sludge from a neglected engine or softening seals on a high-mileage transmission. Or, they may need special throttle-cleaning chemicals that clean throttle body plates without destroying delicate throttle sensors, shaft seals or non-stick coatings. They may also need electrical cleaners that remove dirt and oil from delicate electronics without ruining plastic connectors.

The needs are infinite, and the market is active, provided tire dealers identify those needs and act as sources of quality products that meet those needs. As in the earliest days of the automobile, oils, additives and chemicals will continue to play major roles in today’s professional installer market.